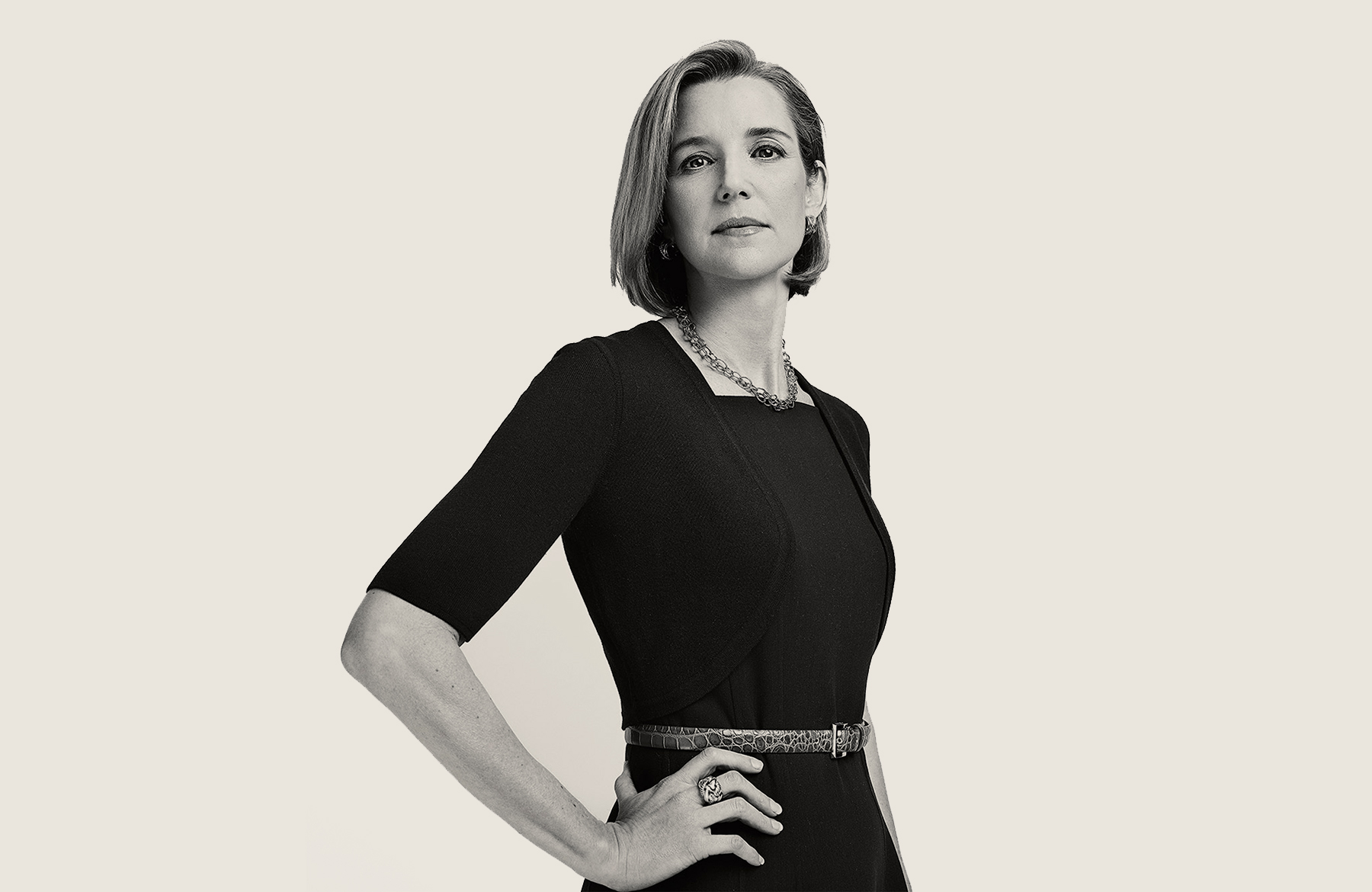

Sallie Krawcheck, one of the most successful executives in financial services, is an influential voice of integrity, a feminist crusader, and has been called “The Last Honest Analyst” by Fortune magazine. She is the former CEO of Merrill Lynch Wealth Management, of Smith Barney and of Sanford Bernstein.

As CEO and Co-Founder of Ellevest, a recently launched innovative digital investment platform for women, Sallie continues to elevate the conversation around women, money and financial feminism. Here, she sits down for a candid conversation with Lindsey Taylor Wood, CEO of The Helm, where they talk about shame, prenups, the patriarchy, being the breadwinner in her family, and the anxiety of being an entrepreneur.

Sallie Krawcheck On Founding Ellevest

You came out swinging with Ellevest. You ignited a cultural conversation about financial feminism and celebrated not only what it means to be a woman as an investor but the success that can come with that. How have people in the financial services industry at large received you?

Well, first of all, YOLO. You know, honestly, if I’m not gonna do this, who’s gonna do this? When I began to recognize the substantial costs that women pay—which is not their fault, because the investing industry does not serve them well—and how much better the industry serves men over women it was like, “Whoa! I’ve just quantified a gender investing gap that costs so many of the women I know—and their nieces, and their friends, and their daughters—hundreds of thousands, and for some women millions of dollars over the course of their lives. I have to do something about this. And if I don’t, shame on me.”

I have to tell you when we started and went out with [the slogan] Invest like a woman, we got some nasty pushback. The majority of it was: “Yeah, this is really interesting… I want to take a look at this… it’s for women? Awesome! I’m in a luck.” But there was a sizable minority of individuals who saw Invest like a woman—and by the way, these are women—and immediately went negative: “How dare you? You’re sexist…You’re patronizing me… Why do you think I need something different from men… I hate you.”

You still get some of that, “How dare you?” But it’s been interesting to watch the evolution of the discussion that’s occurred. The sad part about it is that I have never heard anybody’s initial reaction be, “Oh, invest like a woman, that must mean invest smarter.” It’s unfortunate our society has socialized us in such a way that ‘like a woman’ is immediately taken as ‘lesser.’

The sad part about it is that I have never heard anybody’s initial reaction be, "Oh, invest like a woman, that must mean invest smarter."

Sallie Krawcheck On Financial Feminism

Did you feel that, given a legendary career in financial services, the men and women who knew you felt like, “Of course. This makes total sense?”

No. Absolutely not. But that’s okay. If everybody saw the opportunity, really saw it, then they would have done it.

Everybody’s got a woman’s investing initiative at their firm. I can’t tell you how many meetings I’ve been in over the course of my life where we said, “How do we solve the problem of marketing to women?” What they never recognized as an issue or problem, is that the product was a problem. The product itself. And that the product best served men. The entire investing industry is about outperforming the market, but what we found, after thousands of hours of research with women is that that wasn’t what women were looking for. If they had a choice between outperforming the market and underperforming the market they’d take outperform, but it wasn’t what drove them.

What do they really want? They want to buy a house in six years. They want to start a business in four years. They want to retire well. They want to travel around the world. And all that stuff in between is just a means to an end that they aren’t particularly interested in. Most of Wall Street just gives you the means, they don’t get you to the end. And [Wall Street] blamed women… [they thought] it was really the woman’s fault, women didn’t invest, they needed financial education. Right? So, there is the infantilization of women in this industry; they need financial education. P.S. so do men, but you never hear anybody say that.

Sallie Krawcheck On Apologizing for Success

So now you are at the helm of the conversation around financial literacy and investing in women. Yet, I listened to a podcast you were on and you seemed almost apologetic for your own accomplishment, achievement and wealth. Do you still feel that way? Was that interview a wake-up call?

Yeah. Oh my gosh! I had been—as so many women of my generation were—socialized that talking about money is tacky and crass, and ‘braggy’. So, it really was an eye-opening moment for me. As I think back, how did I ever know what raise to ask for? I didn’t because I wasn’t allowed to talk about it. Right? Eventually, I knew how much money I was supposed to make because it was in the regulatory filing and I looked around and said, “Oh, I am being underpaid.”

So how are you supposed to talk about how to invest if it’s a taboo topic? If you gave me about four glasses of wine, I would go as far as saying it’s the patriarchy that’s keeping us down. If we tell women, and we make women believe, that it’s unattractive to talk about money, then they will not talk about money. And as you know, money is power, and therefore women will lack power because they will lack money.

I don’t want to blame women at all for the gender pay gap because it’s 100%, not our fault, but how are we supposed to close it if we don’t even know how big it is?

It’s the patriarchy that's keeping us down. If we tell women, and we make women believe, that it's unattractive to talk about money, then they will not talk about money.

Sallie Krawcheck On Being Risk Aware

You say that women aren’t risk-averse, they are risk aware. Tell me more about that.

What I mean by risk aware is that women want to understand risk, and they want to understand it in a language that makes sense to them. Men don’t have to understand all the words or all the concepts before they begin to invest.

When I was running Smith Barney, about 86% of our clients did not know what a managed account was. Neither gender would actually ask the questions—I love to joke that it’s because men don’t ask for directions, and women don’t want to bother you—but the men bought it and the women wouldn’t. This becomes particularly acute around the questions of risk in particular: women want to know, “how bad can it get? How much money can I lose?” The solution to this is communicating with women in plain English. By plain English, I do not mean ‘dumbed down.’ There’s no reason in the world that jargon is more intelligent than plain English. So, we have found that in building our product, that if we can show women what reasonable risk should be in their portfolio, they will engage.

Sallie Krawcheck On Saving Versus Investing

How do you think about saving versus investing, and are they synonymous with you?

No, they’re both important. We often hear women say things like, “But saving is safer,” or “It’s more certain.” In reality, what’s more, certain is that if you are just saving and not investing, you are going backward everyday. The yield on savings accounts is so low that with the slight bit of inflation you actually scoot backward a bit.

Sallie Krawcheck On Prenups and Marriage

You mentioned that you had chosen not to have a prenup with your second husband. I found that fascinating because one of my mentors always says to me, “Everyone has a prenup. Either you choose it yourself or the state chooses it for you.” How did you arrive at that decision? Would you make the same decision again?

It’s a great question. If I get married a third time, I will. I didn’t at the time because I viewed it as, “How can we negotiate our divorce before we get married? Don’t you love me?” All of that. But the joke is on me because since we got married I have made more money than my husband. He had more money than I did when we got married by a good measure. But I’ve made more money than he has since we got married, and my net worth is greater than his. It’s hilarious because we actually talk about it as a family. For whatever reason, it’s come up with the kids, and they are like, “Well the joke’s on you, Mom. Shoulda had a prenup that said you got to keep everything you made.” I’m like, “Well, there we have it.”

Sallie Krawcheck On Being the Breadwinner

And how does he feel about that? Did he want a prenup and how does he feel now about you being the breadwinner?

He did want a prenup. But he wanted to get married more than he wanted a prenup. I was never the sole breadwinner. He worked and I worked, and as I became more senior, my compensation eventually exceeded his. And he’s great with it. He really is. My first marriage really ended because it became clear that I was going to be successful. It wasn’t clear that I was going to be more successful, just clear that I was going to be successful. He couldn’t handle it, and my current husband can.

Maybe part of it was because he was much more established in his career than I was when we got married. He’s older than I am. And so there was just never the sense of the two of us being able to compare ourselves to each other, which I think helped. Whereas with the first marriage, we were close enough in age, close enough in our jobs, that if you squinted you could make a comparison. By the way, I have kicked my first husband’s ass since then, just to be perfectly clear.

By the way, I have kicked my first husband's ass since then, just to be perfectly clear.

Sallie Krawcheck On Failure

I love that you shared that. We need to be much more transparent and open about the experience of being a woman in its entirety. By sharing our own stories we invite other women to do the same.

Yeah. This is exactly right, and particularly because you’ve probably seen the same research that I have, that women take failure harder than men do, and so I have too many friends who are embarrassed by failure and work to hide failure as opposed to recognizing failure. We’re all going to fail. We need to normalize failure among women, so [that] when we do, it’s not a life-altering humiliating event, it’s just life.

Sallie Krawcheck On Entrepreneurial Anxiety

You shared that you’d had a panic attack on stage not so long ago. You’ve had high-pressure jobs in the past, running massive firms and managing billions of dollars. Why do you think you feel stress and anxiety now, in a way that you never have before?

Running a startup is harder than running Merrill Lynch.

And by the way, it was trillions of dollars. I mean, you know, big honkin’ company. But there’s a comfort to a big-honkin’ company because you’ve got lots of smart people around you. If you’re running a business that—you know, at the time, I think, was 2 trillion dollars of investable assets and 17 billion dollars of revenue—it’s not you by yourself. You’ve got this great CFO, and a fantastic CMO, and a great operations guy, and a great tax guy, and so you have individuals around you who are excellent at what they do; things tend to be a machine. I remember going through one particularly tough time at Smith Barney and one of the senior execs started saying to me, “It would take a lot to kill this company.” And I thought, “You know what? That’s right. It would.”

Running a startup is harder than running Merrill Lynch

As an entrepreneur, you’re building something from nothing. You recruit individuals to it based on your dream. You raise money from friends based on your dream, and it is not particularly clear that you can make something from nothing. You are always one or two mistakes or three mistakes away from being out of money.

People might say, “Well, why didn’t you do what you’re doing at Ellevest when you were running Merrill?” And the answer is: because I was running Merrill. Changing a business to orient around women is very difficult when you’re running a very successful business that’s oriented around men. I mean, even the logo of the company—the bull, right? That doesn’t really appeal to women, but I assure you that if you tried to change it you would have had every financial advisor, all 15,000 of them, walk out the door.

Sallie Krawcheck On Just Doing It

What is the best piece of advice that someone outside of your family has given you?

When I was first thinking about Ellevest I was going through all of the reasons why the industry says this is not a viable business. And I had an entrepreneur, Bill Harris, who in theory is a competitor, just shake me by the shoulders and say “Just do it. Quit screwing around and do it.” I’m like, “Oh, okay. I can quit screwing around and do it now.”

*The Helm (“Solicitor”) serves as a solicitor for Ellevest , Inc. (“Ellevest”). Solicitor will receive compensation for referring you to Ellevest. Solicitor will be paid $3 for each email registration and up to $1,000 when an individual becomes a client. You will not be charged any fee or incur any additional costs for being referred to Ellevest by the Solicitor. The Solicitor may promote and/or may advertise Ellevest’s investment adviser services. Ellevest and the Solicitor are not under common ownership or otherwise related entities. The Ellevest promotional offer is valid from Sept 19, 2019, to December 31, 2019, for new clients of Ellevest who enter through this designated landing page. Clients who enroll and fund their non-retirement account will receive $25 added to their highest-priority goal in their Ellevest account. Clients who enroll and fund their retirement account will receive a $25 Amazon gift card, which can be redeemed by visiting www.amazon.com. Please review Amazon.com gift card terms and conditions prior to redemption. Ellevest is not responsible for lost Amazon gift cards. Ellevest’s processing time for depositing $25 into a client’s Ellevest account or delivery of a $25 Amazon gift card may be up to 90 days. The information provided should not be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. Investing entails risk, including the possible loss of principal, and there is no assurance that the investment will provide positive performance over any period of time. The information provided does not take into account the specific objectives, financial situation or particular needs of any specific person. Diversification does not ensure a profit or protect against a loss in a declining market.